TRADING TECHNIQUES

TRADING TECHNIQUESdifferent colors to differentiate

descending and

ascending trends. For

each chart I'll discuss

how this technique can

be used to either enter

and stay on the right side

of the trend, or avoid trading

during periods of consolidations.

Standard & Poor's 500

(SP500-HA):

Figure 3 offers no doubt

about the usefulness of

this method, even for a

novice: All trends are visible,

with short consolidations

marked as (4) occurring in February and July. Strong

rising trends (2) were marked by long white candle bodies with

no lower shadows, while strong falling trends (2) were accompanied

by filled candle bodies with no upper shadows.

Using the observations in Figure 2, note how the smaller

bodies (3) in January 2003 warned about a weakening of the

trend, and subsequently, a reversal (4). Trend changes (5) were

pointed out by small bodies with longer shadows, but as an

exception, the reversal in March occurred without any such

sign. Although a rising trend, the segment AB was composed.

of several short sections (normal trend, weakening, consolidation).

It could also be seen as a normal ascending trend (1) due

to a majority of white bodies.forex sato

(The heikin-ashi is a visual technique

that eliminates irregularities from a

normal chart, offering a better picture

of trends and consolidations.)forex sato

- 37.0

- 36.5

- 360

- 35.5

- 35.0

- 34.5

- 34.0

j - 33.5

г 33.0

г 32.5

h 32.0

- 31.5

- 31.0

- 30.5

30.0

29.5

29.0

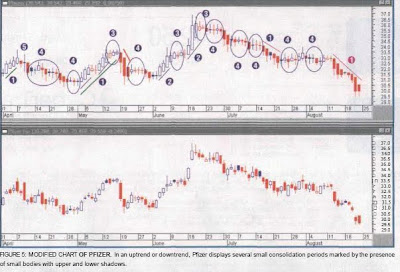

FIGURE 5: MODIFIED CHART OF PFIZER. In an uptrend or downtrend, Pfizer displays several small consolidation periods marked by the presence

of small bodies with upper and lower shadows.

24 • February 2004 • Technical Analysis of STOCKS & COMMODITIES

Another example of the simplicity gained by using modified

heikin-ashi values is in the chart of gold prices in Figure 4. A

longer rising trend (April-May) was dominated by white candles

(1) and (2) with a small consolidation (4) toward the end of April.

The very small body in May was just a pause before the next leg

up; most of the candles were white bodies with no lower

shadows. The smaller bodies toward the end of May announced

either a weakening of the trend (3) or the start of a consolidation

period (4). The consolidation in May-June was well defined.forex sato

(small bodies with both long upper and lower shadows). In

August, there was another consolidation (4). Given the presence

of an ascending triangle, there was a very good chance that

price would break out of this short consolidation.

Pfizer (PFE-HA):

If you have been trading Pfizer (PFE), you should be familiar

with its behavior, which is highlighted in both charts in Figure

5: many small consolidations on the way both up and down.

Gaps are not shown on the modified chart, which makes it easier

to read. The small body with long upper and lower shadows (5)

confirms a change of trend in April. As shown on the daily chart,

the longer trends are not continuous (as in the previous examples),

but interrupted by small consolidations. In this case, it

would be worthwhile to analyze weekly charts.

HEIKIN-ASHI AND SIMPLE INDICATORS

From a visual standpoint, the heikin-ashi technique is based on

the effect of the size and color of the candle bodies. For

additional confirmation, many traders use indicators, so to

make life easier I defined two simple indicators: haOpen and

haClose. I applied these to the chart of Ultimate Software

Group (ULTI). See the second sidebar, "Defining Simple

Indicators Based On Modified OHLC Values," for details on

these indicators. You can see them in a separate window in

forex sato

0 التعليقات:

Post a Comment